How Is Today Different From the 2008 Housing Market Crash?Īmong the differences between today’s housing market and the 2008 housing crash is that lending standards are much tighter now due to lessons learned and new regulations enacted after the last crisis. “It is a ‘paper loss,’ but not an actual loss,” Gumbinger says. Still, he’s hesitant to characterize this as a “bubble pop” or a “crash.” Keith Gumbinger, vice president of mortgage website HSH.com, says if you bought a home for $300,000 three years ago, you could have sold it for $500,000 last year but now can only command $400,000. “While house prices grew at record rates in 2021, the reasons for the increase was not primarily speculation or credit expansion, but rather record-low mortgage rates and a fundamental shift in housing demand.”īut what about people who bought a home during or before the pandemic who are now seeing their home values decline? “A bubble has three defining characteristics: price growth is driven by speculation, bubbles are fueled by credit expansion, bubbles pop,” Kiefer says. Len Kiefer, deputy chief economist at Freddie Mac, doesn’t believe the U.S. “If many buyers share this belief, purchases arising from a ‘fear of missing out’ can drive up prices and heighten expectations of strong house-price gains.” When “there is widespread belief that today’s robust price increases will continue,” the housing market becomes unhinged from those fundamentals, the Dallas Fed report revealed.

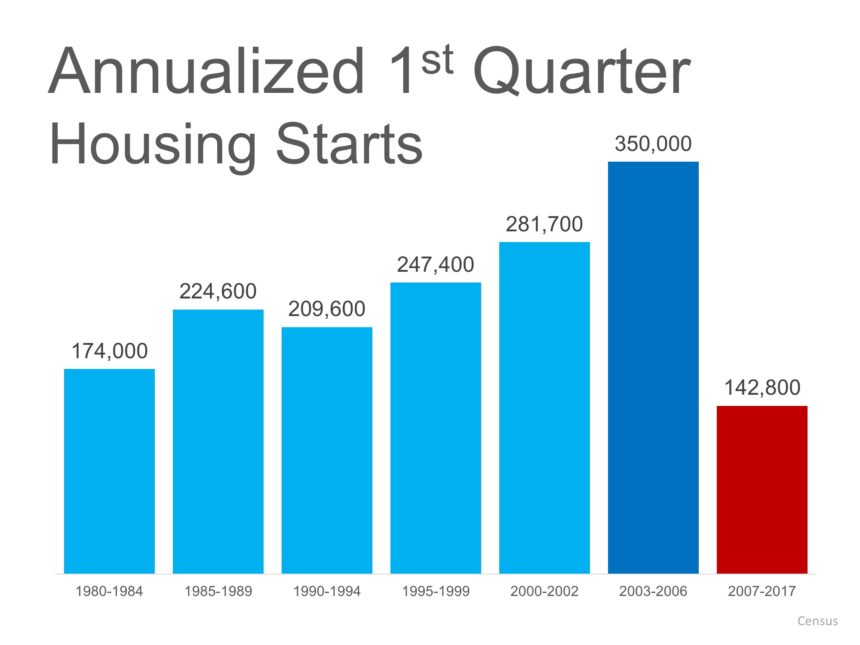

These include “shifts in disposable income, the cost of credit and access to it, supply disruptions, and rising labor and raw construction materials costs are among the economic reasons for sustained real house-price gains.” Though the sharp increase in home prices doesn’t indicate a bubble, the report found, there are other fundamental factors to consider.

The Federal Reserve Bank of Dallas identified signs of a “brewing U.S.

0 kommentar(er)

0 kommentar(er)